Market Analysis :US Stocks Teetering Between Bullish and Bearish Scenarios.

A Quick Markets Update.

I raised a small amount of cash in the PM Stock Trades Portfolio today, which now gives us a total of 17 of 20 possible positions, still a large overall position.

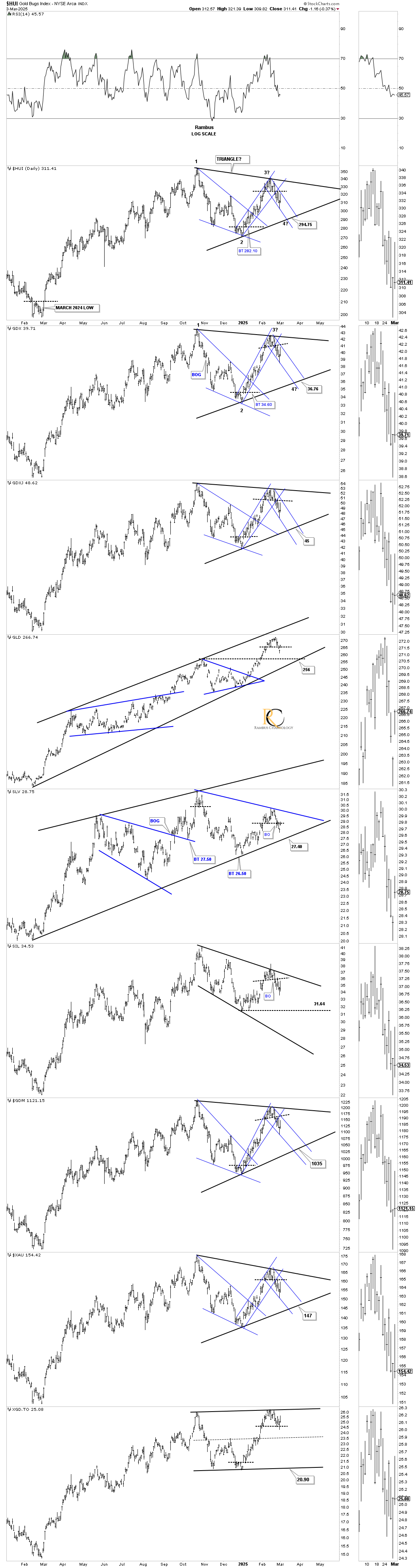

This morning, the PM complex opened higher and then came close to hitting overhead resistance just below the black dashed S&R line below reversal point #3. When I added the downtrend channel between reversal points 3 and 4, I didn’t know how accurate it would be without many touches. Between last Friday’s low and today’s high, it looks like the downtrend channel is in the ballpark. Looking at where the downtrend channel meets the bottom rail of the October triangle, we could still see a week or two of downside price action, unless something miraculous takes place, which would be the exception rather than the rule.

I’m also concerned that if the stock markets begin to break hard to the downside, then the PM complex will probably follow to some degree, even though the PM complex held up very well today with the stock markets down strongly.

Even with the US dollar down hard today, the GDX didn’t seem to pay any attention and found overhead resistance before moving lower once again.